Claim back up to S$500 for what you lost in hidden fees

Campaign period: 14 November 19 - 30 November 19. Full T&Cs apply.

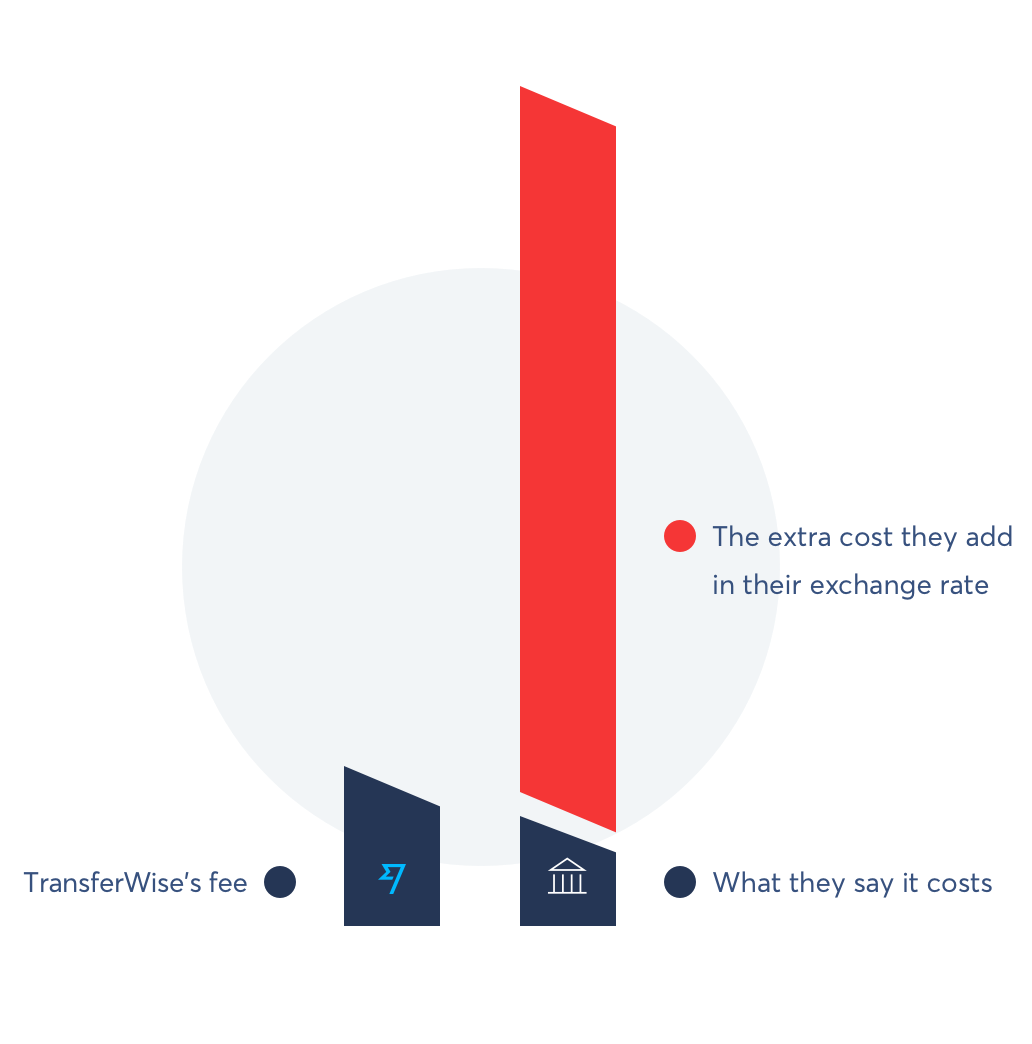

Singapore loses S$2 bn to hidden fees each year

Recently, we won a cash prize at Singapore Fintech Festival 2019. But to raise awareness about hidden fees charged by banks, our CEO Kristo wants to give away the whole S$150,000 — to Singaporeans like you.

Claim up to S$500 on ONE international money transfer or ONE overseas card spend in the past 12 months.

To qualify:

- You must currently live in Singapore OR

- You're a Singapore citizen living abroad OR

- You own a small business registered in Singapore (<50 employees) AND

- You have a Singapore bank account

You'll receive the exact amount you've claimed for, capped at S$500.

How to claim your hidden bank fees

Get an email confirmation

You'll receive an email by 31 Dec 2019 confirming if you're eligible.

Receive the money

Look out for the money in your chosen account — it'll be sent by 31 Jan 2020.

See how Wise helps Singaporeans and expats save money.

Terms and conditions

-

This campaign is open to (i) Individuals living in Singapore (ii) Singapore Citizens living overseas (iii) Any small business (not more than 50 employees) registered in Singapore.

-

Participants can make a claim by showing that they have been charged an exchange rate markup (also known as “hidden fees”) on: (i) a cross-border money transfer with their bank OR (ii) a cross-border card transaction with their bank.

-

Hidden fees are calculated based on the difference between (a) the closing mid-market exchange rate for the day and (b) the exchange rate that the participant was quoted by his/her bank.

-

Hidden fees do not include any fees collected that are separate from and independent of the exchange rate. These may include (but are not restricted to) conversion fees, transaction fees, annual fees or any other additional fees.

-

The transfer or transaction must have taken place between 14 December 2018 0000 hours and 14 November 2019 2359 hours (dates inclusive).

-

Wise will pay eligible participants on a first come, first served basis, with a cap of S$500 per participant, until the S$150,000 sum is fully claimed or until the campaign end date (30 November 2019).

-

Participants have to provide all information and upload relevant documents via this online form.

-

Each participant can only make one claim submission, and each submission can only be done for one transaction.

-

If a participant makes multiple claims, only the first claim will be considered as Wise will consider claims on a first come, first serve basis.

-

Submissions must happen within the campaign period, which begins on 14 November 2019 and ends on 30 November 2019 (dates inclusive).

-

Qualifying participants who send us valid information and documents within the campaign period will be notified via email by 31 December 2019.

-

Submissions containing errors may not qualify. Submissions after 30 November will not qualify. We regret that we may not be able to respond to all non-qualifying participants.

-

Wise will pay qualifying participants the amount equivalent to the hidden fee up to a maximum of S$500 via a direct bank transfer to the participant’s bank account by 31 January 2020. Participants will be informed by email once payment is completed.

-

Participants are responsible for ensuring that bank account details provided are correct. Wise will attempt to make payment only once. Wise will not attempt to make another payment if the first payment is unsuccessful due to incorrect bank accounts provided by participants.

-

By participating in this campaign, participants agree to upload their documents on this online form and consent that Wise can use their personal data for the purpose of hidden fees calculation, identity verification and disbursement of funds.

-

All Wise employees and their family members are not eligible to this campaign.